Avoid Headline Stocks – Boring Businesses Will Make You a Millionaire

By – Published on January 16, 2019

The best performing stock in Canada over the past 10-years and over the past year (2018) have one thing in common – they are boring businesses and all they do is make us money! (both revealed below).

In my VRIC speech I will highlight 3-4 boring money making stocks from our intensive research that offer the same potential and tell you how to avoid the 80% losses produced from headline investing in block chain related stocks.

The financial industry has convinced today’s investor to complicate your stock portfolio with active trading, multiple ETFs, funds, options, futures and other strategies to beat the market long-term. Why? Because it makes the industry money.

Investors are also told they need to jump all over the latest trends to keep your portfolio “relevant” and beat the market today. Without massive exposure to block chain, cryptocurrencies, cannabis, artificial intelligence, machine learning, Internet-of-Things, 3D printing or many of the countless less important hot themes that have come and gone from the markets over the past decade, you will not beat the market.

Do not believe it. If you want to beat the market you cannot be the market.

Stop building overly complicated portfolios which own hundreds of stocks (many funds and ETFs own hundreds of stocks) which basically mirror the market but underperform due to the ridiculous number of fees you pay.

Take control of your portfolio. Build a simple 10-20 stock portfolio of profitable growth and dividend stocks. Do the research yourself if you are qualified or find an independent research service you trust and use a discount broker. You will save money in fees and have a chance at outperforming long-term.

Stop buying into the latest theme or hot trend stocks which often possess little in the way of underlying cash flow and fundamentals. By the time you hear about them, it is often too late.

Making money is sexy. Chasing hot themes is not.

Let’s look at a real-world example.

Block Chain and Cryptocurrency Related Stocks

At the end of 2017 and heading into 2018 one of the single hottest segments of the market was anything related to block chain or cryptocurrencies. I could not go anywhere, the soccer field, dentist, grocery stock, etc, without getting asked how to get involved. Our clients were clamouring for recommendations in these areas – and it was hard to blame them. From Saturday Night Live to CNBC and at the Oscars, the investment arena and pop-culture alike were head-over-heals for these shiny new objects.

Our analysts considered the segment – we review every company in Canada and thousands in the US twice a year, so we were bound to come across a number of related stocks.

In fact, at the time our research uncovered 14 cryptocurrency related stocks in Canada and the U.S. Our issue with the companies was that only 4 had revenues on a quarterly basis of over $100,000 and only 2 over $1 million. As for block chain related stocks in Canada and U.S. we uncovered 35. Only 6 had revenues on a quarterly basis of over $100,000, and only 2 over $1 million. Not a single company was profitable. Despite this, several had market caps approaching $1 billion.

None of the companies from this ultra-hot sector that investors were selling their firstborn to get involved with met KeyStone’s initial criteria. We chose not to recommend a single stock in this segment in 2018.

We are very happy to have reached this simple conclusion.

Of the block chain and cryptocurrency related stock we tracked from our research, the average loss in 2018 was in the range of 80%. That is the average loss – a massive destruction of investor capital.

Example: HIVE Blockchain Technologies Ltd. (HIVE:TSX-V) – loss of just under 90% in 2018.

Losses of this magnitude can be catastrophic to your portfolio and should serve as a reminder of the potential pitfalls of chasing hot trend stocks devoid of underlying fundamentals.

Losses of this magnitude can be catastrophic to your portfolio and should serve as a reminder of the potential pitfalls of chasing hot trend stocks devoid of underlying fundamentals.

What Should You Do?

Simplify your portfolio, buy 10-20 select Canadian & U.S. growth and dividend stocks. Focus on buying great cash producing businesses and less on hot themes.

Buy more stocks like Boyd Group Income Fund (BYD.UN:TSX) and XPEL Inc. (DAP.U:TSX-V).

If you are not familiar with these stocks, you are not alone. Both stocks have limited to no coverage on Wall or Bay Street. While you should have seen them recommended by your bank, broker, advisor, or fund manager, you did not. Why? Quite simply because they enrich shareholders, not the finance departments on Wall and Bay Street, so they have limited interest in covering them – despite the fact that Boyd Group is the single best performing stock on the TSX over the past decade and XPEL Inc. was one of the best performing non-penny stocks in Canada in 2018.

I confess, Boyd Group and XPEL Inc. are the two boring businesses I referenced at the start of this piece.

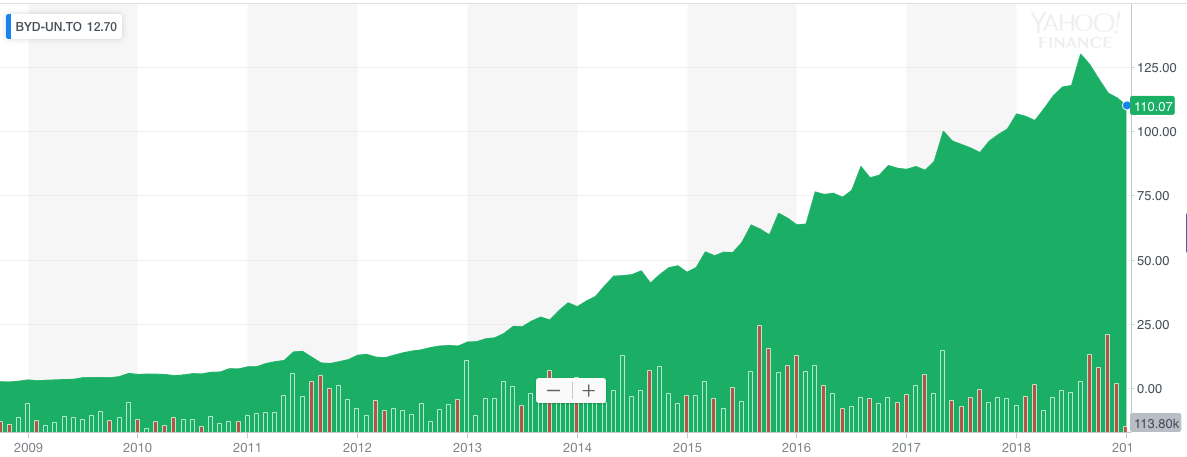

Boyd Group has grown to become one of the largest operators of non-franchised collision repair centers in North America in terms of number of locations and sales. They basically fix a great deal of cars, specializing in auto glass repair. The stock was originally recommended by KeyStone in 2008 at $2.30. Today the shares trade in the $111.25 range and have paid our clients over $3.50 in dividends since the recommendation for a return 4,890% over the past decade – making Boyd the single best performing stock on the TSX over that period.

Boyd Group Income Fund (BYD.UN:TSX) – 10-Year Performance

XPEL Inc. markets and sells automotive paint protection and window films – that film that helps prevent scratched, dings, and rock chips. Pretty mundane business you say? There is nothing mundane about the 332% gains the stock has posted over the past year – all driven by record revenue, earnings and cash flow growth. XPEL was recommended to KeyStone clients in the Fall of 2018 at $1.42 and in early 2018 at $1.59. The stock trades beyond $6.00 today. For the first nine-months of 2018, earnings jumped 476% to $0.242 per share from $0.042 in the same period of 2017 – that will drive a stock price!

And it has…

XPEL Inc. (DAP.U:TSX-V) – 1-Year Performance

The proof is in the results.

While jumping on the latest trend or hot investment theme can seem irresistible and sexy at the time, it often leads to very poor average returns long-term.

Focussing on cash producing “boring businesses” may not be sexy, but they can make you money and money is sexy.

The eye-pooping returns of both Boyd Group and XPEL Inc. show us that boring businesses can set you on your path toward becoming a multimillionaire.

My speech on Sunday at the VRIC will recommend at 3-5 truly unknown boring businesses – potentially the next Boyd or XPEL.

Comments